Eidl loan payment calculator

Current Mortgage Rates Up-to-date mortgage rate data based on originated loans. Pdf SBL Update 12182020 new affordability test 2021 mission requirements fhfa sbl small balance loan guide bulletin chapter 8sbl15 inspection scheduling approval conditions exception requests programmatic exceptions credit risks chapter 9sbl2c2 small talk series jake simpson happy holidayspdf SBL Update 12112020 december tips tricks new fields in.

Pin On Ppp

If youre trying to decide which loan is best for your business take a look at GNO Incs comparison chart.

. Mortgage Calculator Found a home you like. LoanBuilder is a PayPal Service that offers loans to small businesses without the need for them to use PayPal as a payment processor. Loan Forgiveness Application Revised June 16 2020.

10 billion for SBA EIDL Advance grants. Learn more about this loan including qualifications and how to apply. Since 1939 our firm has assisted thousands of businesses and individuals reach their financial goals.

OMB Control Number 3245-0407 Expiration Date. SBA PPP Loan Number. The interest rate will tell you a lot but to fully understand the cost of an SBA loan youll need to have more information including the APR and the total cost of borrowing.

PPP Loan Proceeds Deduction Limit. 차 리스 후 구입. Recognize the payment over the.

Hora oficial del este. The COVID-19 Economic Injury Disaster Loan EIDL and EIDL Advance programs provide funding to help small businesses recover from the economic impacts of the COVID-19 pandemic. The PPP program is forgivable in some cases up to 75 if actually used for payroll purposes.

The CAA allows taxpayers to claim a federal deduction for business expenses funded by forgiven PPP loan proceeds. Use this calculator to find out. Depending on eligibility business owners and companies can receive up to 26000 per employee based on the number of W2 employees you had on the payroll in 2020 and 2021.

The Virginia deduction may be claimed solely for Taxable Year 2020. You can also use the calculator for the PPP and EIDL loans available for companies in the US as well as for estimating the impact of an equity investment. Disaster Loan Advisors can assist your business with the complex and confusing Employee Retention Credit ERC and Employee Retention Tax Credit ERTC program.

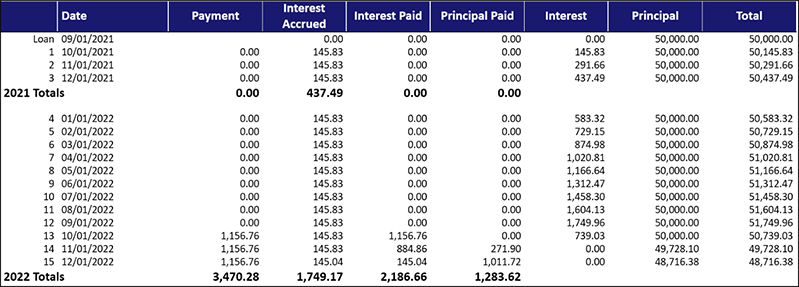

It includes draws principal repayments interest and a possibility to forgive a part of the loan. Separate EIDL Advance grants were intended to give small businesses applying for this loan up to 10000 upfront. In special cases small businesses may receive loans up to 100000 if needed.

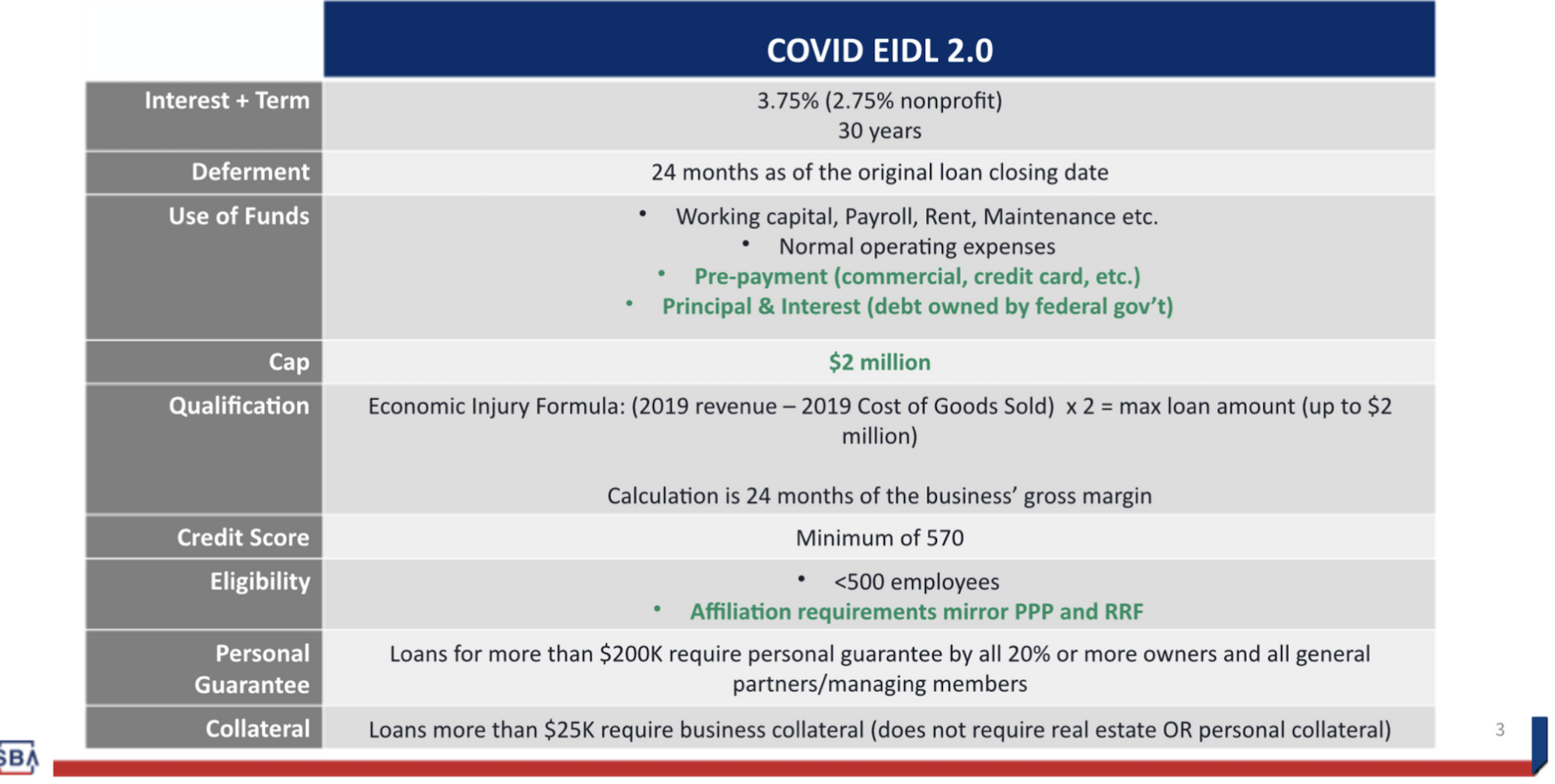

Business Legal Name Borrower DBA or Tradename if applicable Business Address Business TIN EIN SSN Business Phone - Primary Contact E-mail Address. The EIDL loan is a loan at 375 interest. There are two types of COVID EIDL funding.

SBA 7a Loan Calculator. LoanBuilder offers short-term business loans a type of interest-free loan in which borrowers repay a predetermined fixed fee along with the borrowed amount. The Economic Injury Disaster Loan or EIDL is designed for businesses with fewer than 500 employees.

Historical Mortgage Rates A collection of day-by-day rates and analysis. PPP loan is processed by a bank and used primarily for payroll whereas the EIDL loan is processed by the SBA and used for general business expenses. Your lender will ultimately notify you of how much of the loan is forgiven and where applicable the date your first payment is due.

The Treasury Offset Program TOP is a debt collection program administered by the Bureau of Fiscal Services BFS which is a division of the US. PPP Loan Forgiveness Calculation Form. If you have an SBA 7a loan offer use the SBA loan calculator below to get estimates on everything you need to know to make an informed.

COVID EIDL loan funds may be used for working capital and other normal operating expenses. First payment date. 식당에서 쉬는시간에 대해 강제로 임금을 뺍니다.

The advance didnt and still doesnt have to be repaid. At KROST we offer tax accounting and consulting services with an industry-focused approachOur award-winning firm can provide a unique package catered to the needs of your specific situation. Pago de impacto económico también conocido como pago de estímulo económico Economic Injury Disaster Loan EIDL Préstamo por Desastre por Daños Económicos EIDL por sus.

PPP Loan Forgiveness Terms. The Consolidated Appropriations Act signed into law at the end of December 2020 allocates 284 billion to the popular PPP program. As for loan amounts eligible small businesses can take advantage of one-year interest free loans of up to 50000.

To qualify applicants must have been established before March 9 2020 and suffered economic injury for coronavirus-related causes according to the. 아파트 파킹랏 시큐리티 카메라. 75 billion for hospitals and health care providers.

These grants were for all qualified applicants whether they were approved for the loan or not. In practice the EIDL grants ended up being 1000 per employee for up to. Best Mortgage Lenders Independently researched and ranked mortgage lenders.

The examples below illustrate this methodology. Finally the update adds a loan calculator. Add the outstanding amount of an Economic Injury Disaster Loan EIDL made between January 31 2020 and April 3 2020 less the amount of any advance under an EIDL COVID-19 loan because it does not have to be repaid.

The PPP and EIDL are different loans. No employees make more than 100000. Show by year show by month.

Calculadora de límites de ganancias. Department of the TreasurySection 303 m of the Social Security Act requires DWD to send eligible unemployment compensation debts to TOP for offset of the debtors federal income tax refund. Calculate your monthly payment here.

It also allocates 40 billion to a new version of the Economic Injury Disaster Loan EIDL Grant and 15 billion to a new grant aimed at live entertainment venues impacted by the COVID pandemic. Virginias Conformity legislation limits the deduction to 100000 for business expenses funded by forgiven PPP loan proceeds.

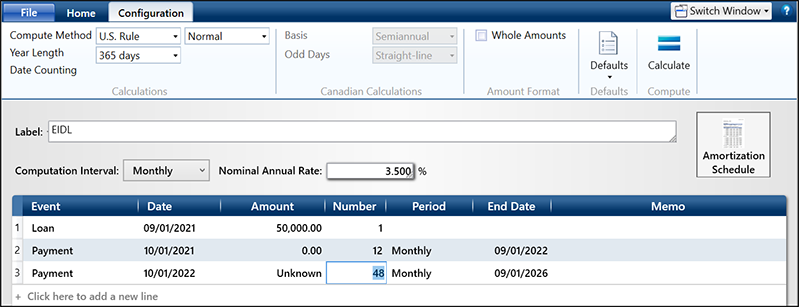

Economic Injury Disaster Loans Eidl Timevalue Software

Here S How To Fill Out The Targeted Eidl Advance Application

Eidl Loan Up To 2 Million Homeunemployed Com

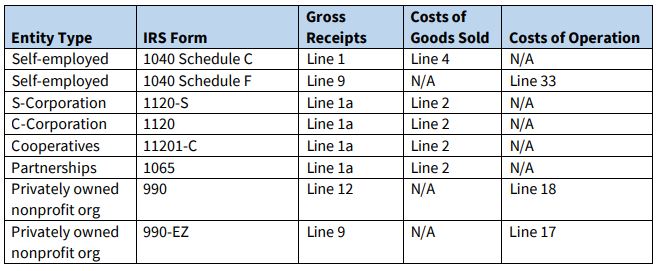

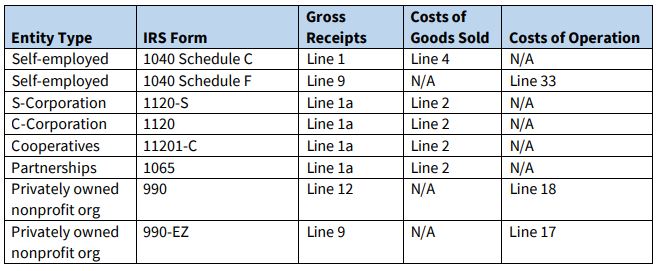

The Eidl For Sole Props And The Self Employed Bench Accounting

How Much Eidl Loan Increase Can I Get 2021 Amount Of Sba Eidl Loan

Exclusive 2m Eidl Loan Cap Go Live Details

Economic Injury Disaster Loans Eidl Blp Business Lending Partners

New Sba Targeted Eidl 10 000 Grant Application Step By Step Instructions Freedomtax Accounting Payroll Tax Services

Targeted Eidl Grant How To Calculate Gross Receipts Youtube

Pin On Ppp

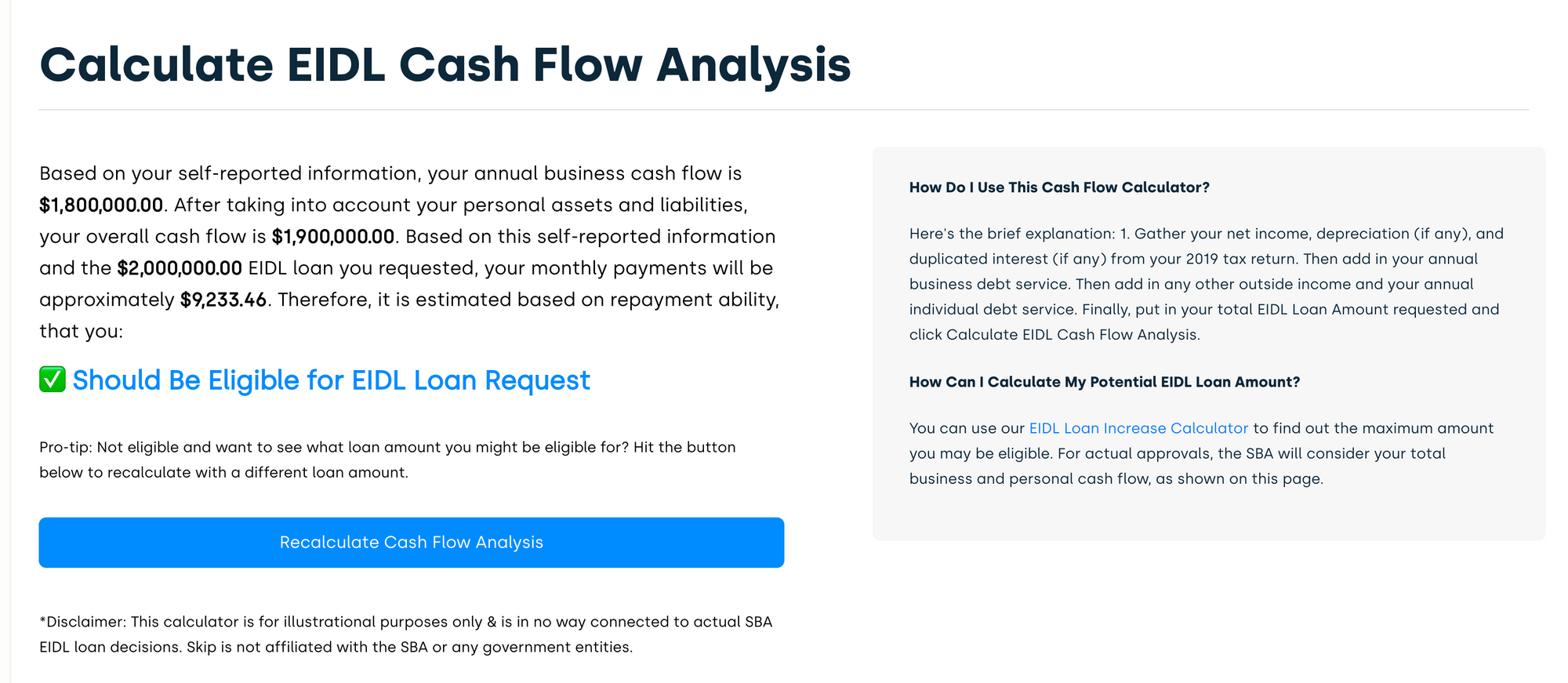

How To Check Eidl Approval With Cash Flow Calculator

Self Employment 1099s And The Paycheck Protection Program Bench Accounting Self Employment Paycheck Payroll Taxes

Economic Injury Disaster Loans Eidl Timevalue Software

Economic Injury Disaster Loan Emergency Advance Eidl

How To Calculate Your Eidl Loan Amount Lantern By Sofi

Ppp Loan And Eidl Grant Tuesday Update

Pin On Food